Supercharge Insurance Sales and Marketing

with Software That Keeps Your Business

Open All Day Long

Whether your primary business is done through traditional face-to-face, telephone, E-commerce

sales or all of the above, Quotit offers you solutions that transform your customer’s

experience with convenience, personalization, and automation.

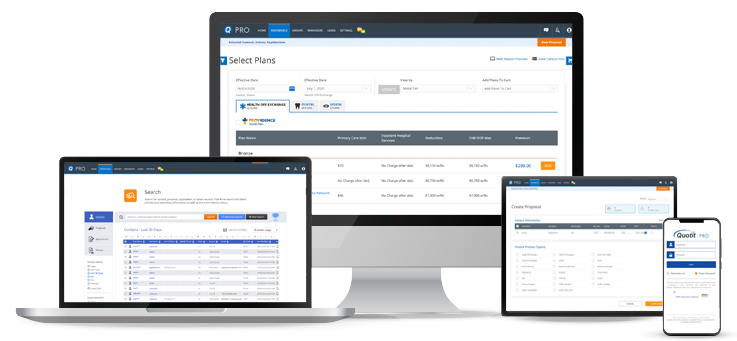

The Tools You Need to Succeed

Invest in health insurance software to build more efficient and productive processes that delight your clients in each interaction. Whether you are looking for a turnkey solution or access to consolidated data and functionality, we’ve got you covered.

Health Plan Data Access

Included in our out-of-the-box solutions or stand-alone cloud-based API, the backbone of your operation is access to health plan data from hundreds of carriers across the country in one place.

Learn MoreProfessional Quoting Engine

Send professional-looking quotes with plans from a multitude of carriers that would otherwise require you to manually visit multiple carrier websites to find qualifying health plans.

Learn MoreCompare and Enroll

Compare hundreds of plans from carriers across the country around the clock—or give your clients access so they can shop on their own. With our shopping cart feature, clients can enroll directly from their proposals.

Learn MoreClient-Driven Shopping

Provide instant access for your prospects to shop, compare, and enroll in insurance plans from multiple carriers using our consumer-facing quoting add-on for any website.

Learn MoreEnd-to-End CRM

Organize client and lead information in one place to personalize outreach, improve customer satisfaction, and drive more revenue. Even set reminders for events such as birthdays, plan renewals, and the open enrollment period.

Learn MoreStreamlined Enrollment

Consolidate enrollments to include multiple products in a single application; also, leverage our Enhanced Direct Enrollment (EDE) capability to easily and seamlessly onboard new on-exchange clients.

Learn MoreHelp Me Choose the Right Solution

To get a better idea about how Quotit can take your business to the next level,

check out our plans and pricing, designed specifically for your needs.